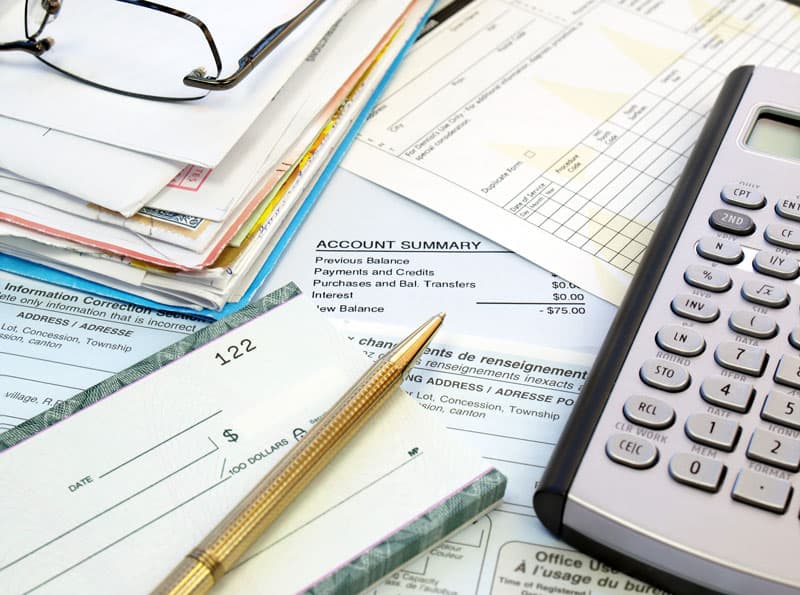

Revenue and Receivables

In most businesses, what drives the balance sheet are sales and expenses. In other words, they cause the assets and liabilities in a business. One of the more complicated accounting items are the accounts receivable. As a hypothetical situation, imagine a business that offers all its customers a 30-day credit period, which is fairly common in transactions between businesses