When preparing to send an invoice to a client, it’s essential to include all necessary details. This helps you stay professional and avoid payment delays. Consider what makes your invoice informative and a good reflection of your brand.

Consistent branding and clear payment terms are important, but what else should you check to ensure a smooth transaction? There are additional considerations to keep in mind if you want the invoicing process to run smoothly.

1. Essential Contact Information

A well-crafted invoice begins with essential contact information, acting as the cornerstone of effective communication. You must prominently display your business name, ensuring customers recognize whose billing is being handled.

Include multiple contact methods, such as a phone number and email address, which enhance customer engagement by providing avenues for inquiries. Providing a physical address adds a layer of trust and facilitates correspondence.

Communication clarity is achieved when your customers can easily reach out with questions or concerns. Responsive support is crucial, so ensure your contact details are accurate and up-to-date.

By prioritizing accurate information, you minimize miscommunication and build strong professional relationships. This approach ultimately enhances customer satisfaction and promotes timely payments.

2. Consistent Branding Elements

Your company’s logo acts like a signature on your invoices, instantly conveying professionalism and identity. By incorporating your brand identity into each invoice, you ensure that clients recognize your business instantly.

Stick to your design guidelines for visual consistency across all documents. This means using the same logo placement and adhering to your color palette to reinforce your brand’s image.

When you maintain consistency in these elements, you create a seamless experience that aligns with your branding strategy. Consistent branding is more than just looking good; it builds trust and makes your business seem trustworthy.

3. Unique Invoice Tracking

While consistent branding elements ensure your invoices are visually aligned with your business identity, assigning a unique tracking number to each invoice enhances its functionality.

This simple step boosts your invoice management by streamlining tracking efficiency and payment tracking. With a unique number, you can quickly locate invoices, improving your overall invoice organization.

Plus, it simplifies client communication. When clients have questions, referencing the invoice by its number avoids confusion and speeds up resolution times.

Incorporating unique tracking numbers not only aids your internal processes but also fosters a more professional image to clients. You’ll find payments easier to track and manage, reducing the chances of missed or delayed payments.

This strategy is a crucial component of effective invoice management.

4. Accurate Recipient Details

Imagine opening a letter that’s not addressed to you—frustrating, right? That’s why accurate recipient details on your invoice are crucial.

Use recipient personalization strategies, such as including your client’s name and contact information. This small touch enhances effective communication techniques and fosters stronger client relationships.

Ensure these details are accurate to support your client’s best record-keeping practices. An error here could lead to confusion or delays, undermining your professionalism.

Follow up on invoices using established methods to confirm receipt and address any discrepancies promptly.

Accurate recipient information ensures your invoices reach the right person, making the payment process smoother. Investing time in this step fosters trust and encourages timely payments, benefiting your business in the long run.

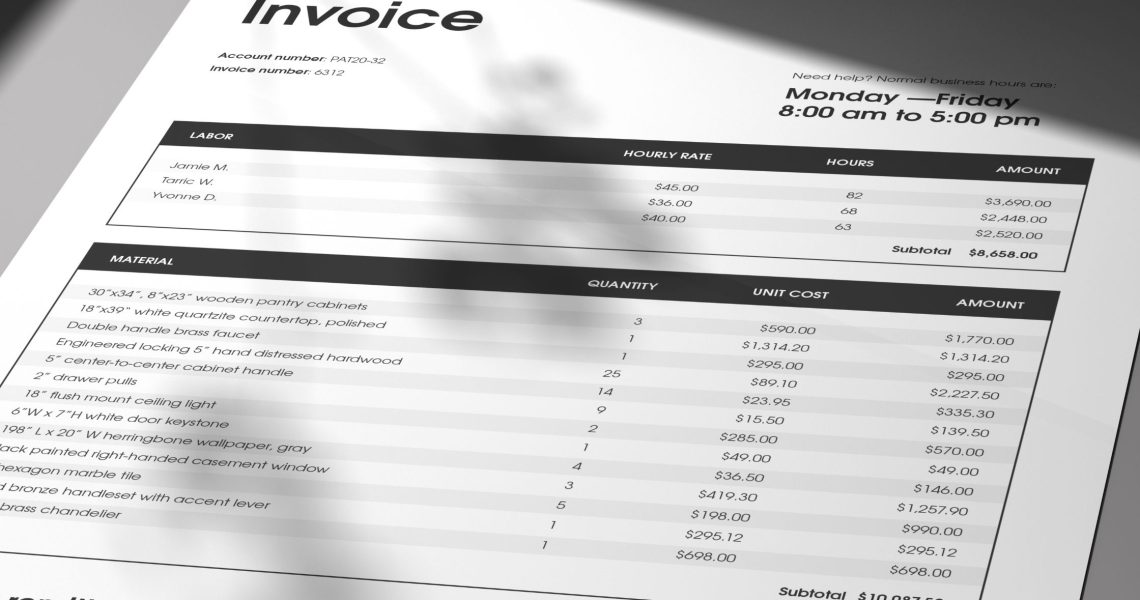

5. Detailed Product/Service List

Craft a comprehensive list of all products or services provided to ensure clarity and transparency in your invoices. By emphasizing product clarity and service transparency, you help your clients understand exactly what they’re paying for.

Detail importance is crucial here; including specific descriptions, quantities, and unit prices will aid in customer understanding. It’s essential to break down pricing to show how each item or service contributes to the total cost.

This approach not only prevents confusion but also builds trust and strengthens your professional relationship. Avoid vague language; be precise in your descriptions.

A well-structured, detailed list can make a significant difference in how clients perceive your professionalism and the value of your offerings.

6. Clear Payment Terms

Clear payment terms are essential for avoiding misunderstandings and ensuring timely payments. You should specify the payment due date, accepted payment methods, and any grace period in your invoice formats.

This transparency helps streamline payment processing and strengthens client communication. Consider setting up automated payment reminders using billing software to keep clients informed and prompt timely payments.

Clearly communicate these terms to your clients so they understand exactly when and how to make a payment. This proactive approach reduces confusion and fosters trust.

7. Defined Late Payment Penalties

To ensure smooth financial interactions, it’s essential to detail not only the payment terms but also the repercussions of missing them. Clearly define late payment penalties, specifying penalty percentages for overdue invoices. This transparency helps clients understand the financial impact of delays and encourages them to make timely payments.

Send timely payment reminders and overdue notifications to keep clients informed and proactive. Regular client communication can prevent misunderstandings and foster a positive business relationship.

Additionally, establish a dispute resolution process to address any disagreements regarding penalties. By outlining these elements, you mitigate potential conflicts and demonstrate professionalism.

8. Organized Invoice Structure

An organized invoice structure is vital for ensuring clarity and professionalism in your billing process.

Start with clear invoice formatting tips: use sections and headings to guide your client effortlessly through the document. This approach enhances customer communication strategies by making your invoices easy to understand.

Include details like payment processing options prominently, so your clients know exactly how to pay you. Incorporate invoice follow-up techniques by adding a polite reminder about due dates and contact information for any queries.

Embrace the benefits of digital invoicing, including automated reminders and easy access to past invoices, which streamline the process for both you and your clients.

An organized structure streamlines payments and fosters stronger client relationships.

Boost Your Business with Accountant Cape Coral’s Expertise

Precision and reliability are essential in any business, and your invoices should reflect these qualities. Accountant Cape Coral understands the importance of a well-structured invoice as a vital communication tool between you and your clients. With years of experience and a commitment to excellence, we offer professional bookkeeping and accounting services that ensure your financial processes are seamless and effective.

Our team of experienced experts guarantees that your invoices include all necessary details while also helping to build a strong financial foundation for your business. By partnering with Accountant Cape Coral, you gain a dedicated ally who prioritizes your success, allowing you to focus on what you do best while we manage the complexities of your financial activities with accuracy and care. Rely on us to enhance your professional image and strengthen client relationships through our dependable services.